It’s 2019. Where the f*ck is Our Global Peer-to-Peer Electronic Cash System?

Originally published 15 April 2019.

This article is a repost from early 2019. It got pretty popular and still has some lessons applicable for today.

The company we built on this; too early and died last winter due more to lack of runway to build than lack of users.

Later this year I might revisit the progress on the problems defined here, as well as lessons learned.

— Tom

This problem is one that has frustrated me for decades, it is what drew me to fintech and crypto, and the lack of solutions I found while researching for this article is what has driven me to step back from Taureon angel group and back to the startup building side. More on what we are building later in the article.

Where is the decentralized money we were promised?

Bitcoin was launched over 10 years ago, with a simple promise:

However, all variants of Bitcoin and other top cryptocurrencies that we have today, do not fulfill this promise.

Before the various cryptocurrency maximalists start evangelizing that their pet cryptocurrency already does this, let me take a moment to define exactly what peer-to-peer electronic cash system means to me.

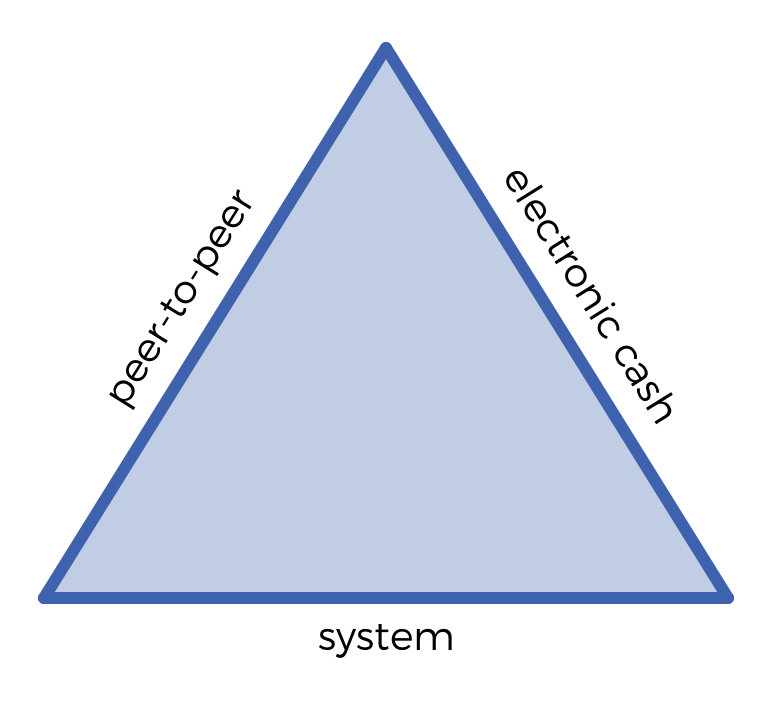

“Peer-to-Peer”

To me, this means decentralized, self-sovereign, censorship resistant. This means I own and control my part of it, no one can revoke it or otherwise stop me from having or using it.

“Electronic Cash”

To me, this means I can use it as money in my day to day life. This means it is fast and cheap to transact, and this means that the value of it is relatively stable. My purchasing power does not change much from holding it.

“System”

A system is holistic. It is not only comprised of the backend decentralized ledger, but the entire user experience, which means the app interface, the ecosystem, and everything in between.

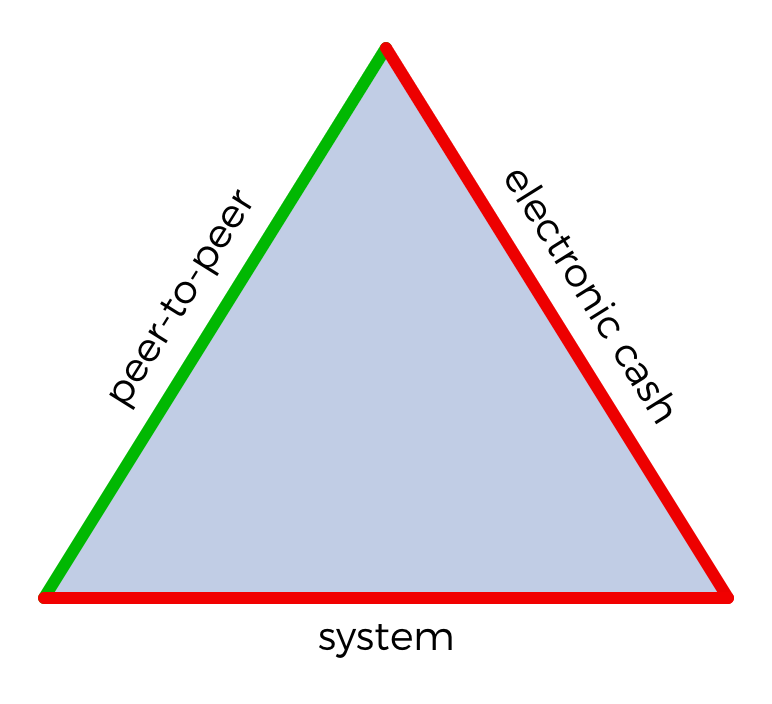

Most Cryptocurrencies are “Peer-to-Peer”

Most of the top cryptocurrencies check the first box, “peer to peer”.

Bitcoin and it’s forks, Litecoin, Dash, and various others are decentralized, self-sovereign, censorship resistant, and peer to peer, in varying degrees.

Bitcoin with its superior hashing power is probably the most safe and censorship resistant, while Dash has a strong boots on the ground merchant adoption program and Ethereum’s smart contracts are enabling an ecosystem of open finance products.

One can debate the nuances of the various project’s degree of decentralization for quite some time, but given that they are considerably more decentralized than existing fiat systems, the networks are good enough to use for now.

Almost None are “Electronic Cash”

All of the top cryptocurrencies are highly volatile and therefore useless as a unit of account or store of spending money.

When my friend sends me BTC to buy him a car on Friday, and I can only buy 75% of that car by Monday, that BTC is unusable as a form of cash or money.

Sure it may turn out to be a good store of value in the long term, say 3 years, but that doesn't make it cash any more than oil or soybeans are cash.

Yes, electronic cash must also be useful as daily spending money. Buying a meal needs to be quick and frictionless at all times, which means 10 minute transaction times and $5 transaction fees will also make a currency unusable as cash.

But if I had to rank the barriers to electronic cash, value volatility is the number one barrier to adoption, fees and speed come after.

The “Systems” are Incomplete

Everything currently on the market is an incomplete experience.

We have a lot of backend ledgers of varying completion, but I have yet to see that combined with an easy to use front-end and robust ecosystem.

While we have plenty of wallets that allows users to manage multiple cryptocurrencies, we don’t have a wallet that simply allows you to send cash to your peers, with an easy to use app interface.

So how is it that in 2019, over 10 years since Bitcoin was launched, we still don’t have a complete peer-to-peer electronic cash system?

Let’s Finish Building Bitcoin’s First Use Case

It is clear to me that for decentralized technologies to thrive, we must all come together to solve the first use case of blockchain and cryptocurrency: electronic cash.

Through my research, I’ve discovered that many of pieces needed to make this happen, did not fully exist during the first 10 years of Bitcoin’s life, which is why it’s taken a bit longer than expected.

However, due to the funding wave in 2017, both technical and market developments in the past year finally give us all the pieces we need to fulfill the vision of Bitcoin.

How to create a Peer-to-Peer Electronic Cash System

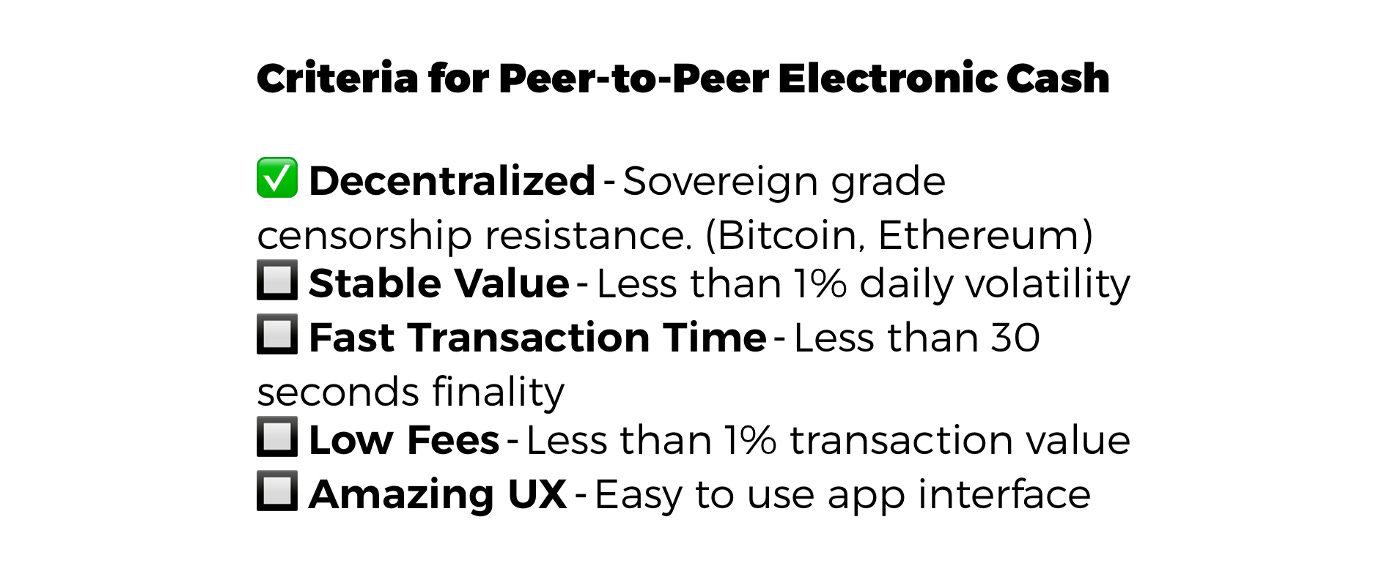

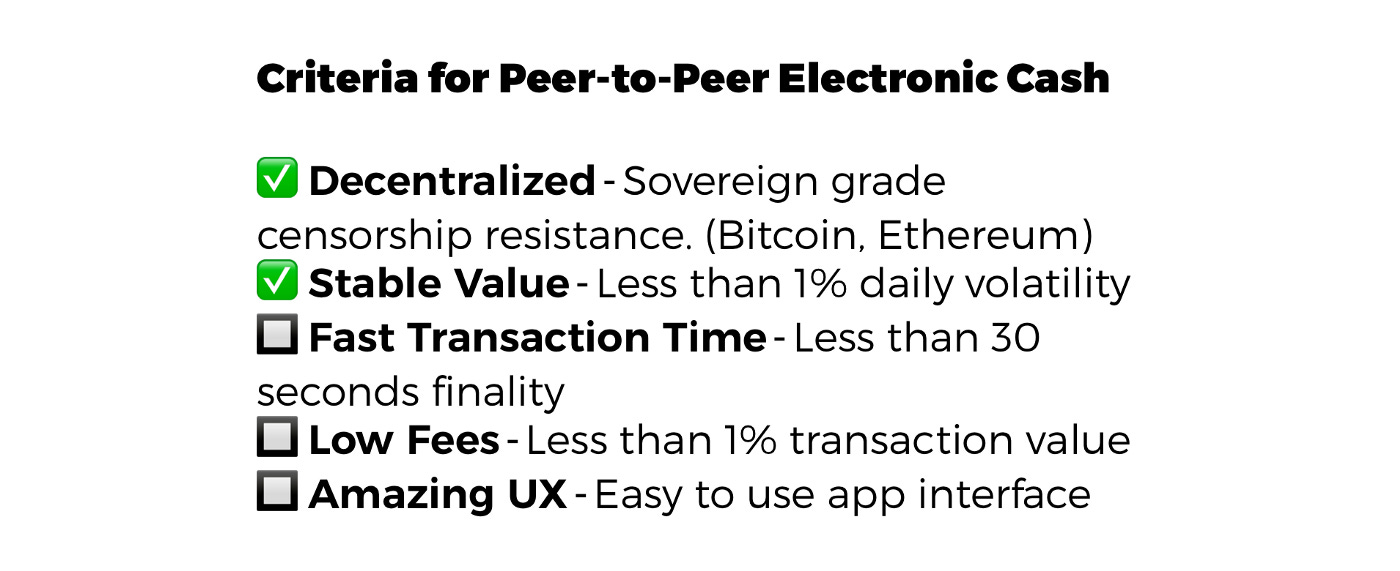

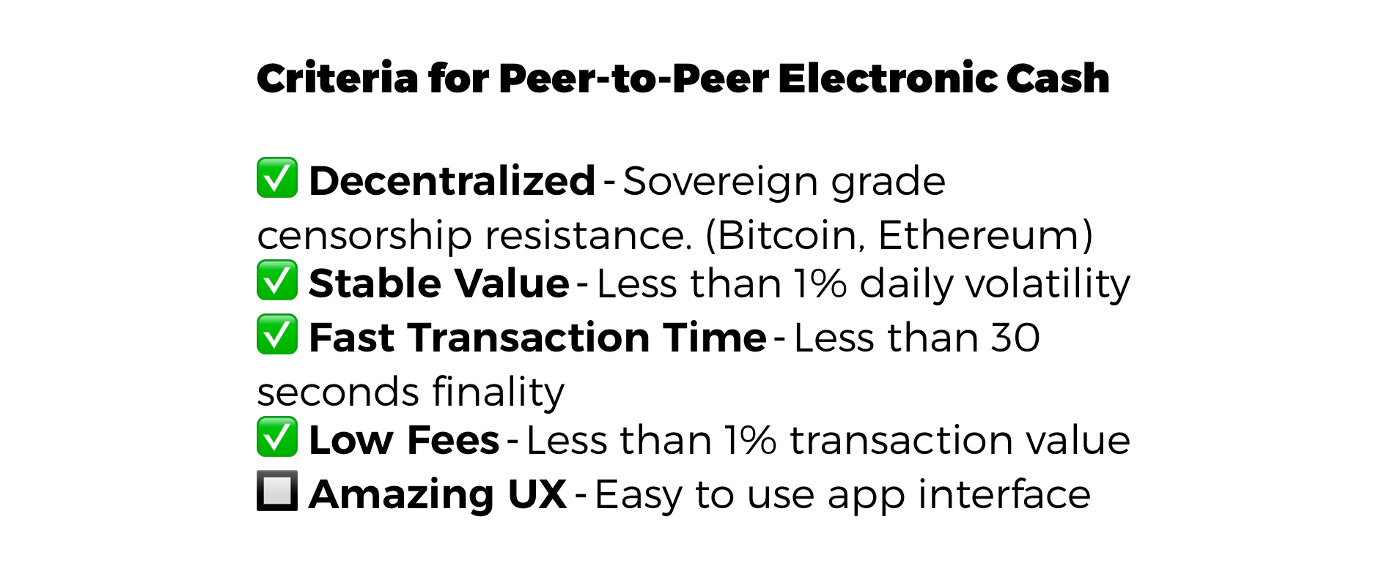

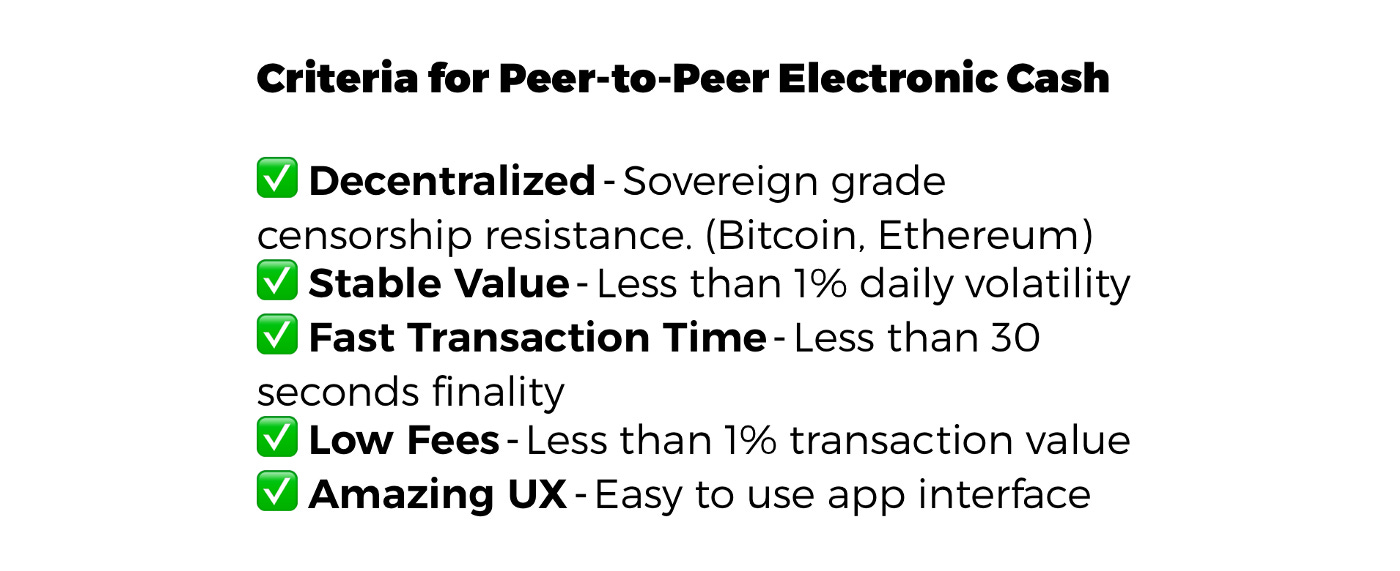

So far I’ve defined some of the criteria of a peer-to-peer electronic cash system:

As an ecosystem, we’ve clearly got 1 out of 5 requirements fulfilled; we have many decentralized ledgers with varying degrees of censorship resistance, of which Bitcoin and Ethereum are leading the pack.

The remaining criteria don’t have any clear leaders yet, but as new technology is developed, the pieces need to seem to be available or nearly available today, they just have not been assembled in the right order.

So how can we go about assembling the other parts of this system?

Before digging into the possible technology we could use, let’s first consider the User Experience so that the system we design is able to get real usage and adoption.

What actually gets adoption? What do users actually want? What problems are people experiencing?

What do users want — The User Experience

I can only draw from my own experiences and observations here, but I suspect I have a somewhat diverse set of experiences and observations to draw from, having lived and traveled among the rich and the poor, been dead broke and well off, in developed countries like US and Germany and in developing countries, particularly those in South East Asia.

In all my travels, I found there are some universal truths about people:

People want to have a contented and fulfilling life with their family and friends

This means they need things that keep them alive, safe, and happy, which they buy with money

This means they need to earn, save and grow their money

And all of this boils down to a simple desire for their money:

People just want to safely send and receive their money between people they know and merchants they engage.

Breaking that down reveals additional desires:

“Just send and receive”

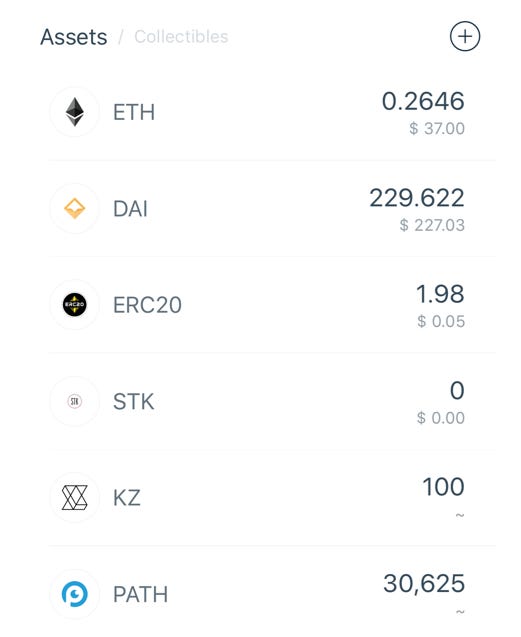

The biggest issue I see with most crypto asset wallets is that they meant for managing a multi-asset portfolio, making them complicated and confusing. For users that want to “send money”, they don’t really care about the various crypto assets, they just want their value to be easily usable to send money to other people or merchants.

Users want to send a receive value, denominated in and pegged to whatever currency they think in, such as USD or Thai Baht, not BTC or ETH.

This also means the money they are sending around does not violently fluctuate in value as that makes it unusable.

Users don’t care how the backend works, as long as they can be reasonably sure that their money will never be lost or taken, and never lose value, ever.

This means the front end needs to simply send the users currency of choice around without exposing them to the complexities of making that happen.

“Safe money”

This can mean different things to different people, but in general this means their money

does not lose its value due to inflation or otherwise

can’t be randomly “lost” or delayed by banks

can’t be arbitrarily seized by governments

can’t be stolen by common thieves

In developed countries such as the US, most people believe that USD already fulfills these criteria. Europe mostly believes this as well, though confidence in EUR and other European currencies has faltered after losing 30% against USD a few years ago.

In developing countries, people generally believe that their local currency is at risk on all 3 factors above, yet they often have no choice but to use it. As a result you often see people putting savings into USD, gold, and real estate, and keeping the local currency for spending.

People tend to avoid keeping too much in the local banks as the banks are prone to being “hacked”, going insolvent due to embezzlement, or being seized by the government for the crime of doing too well without including the bosses.

Because of this, I believe that developing countries are ready to adopt an easy to use cryptocurrency system, even if the inflation rate of their local currency is reasonable.

“People they know”

Users do not care for 32 digit hexadecimal addresses.

Users conduct transactions between people, not between computers, so any system relying on computer addresses will face a lot of friction for adoption.

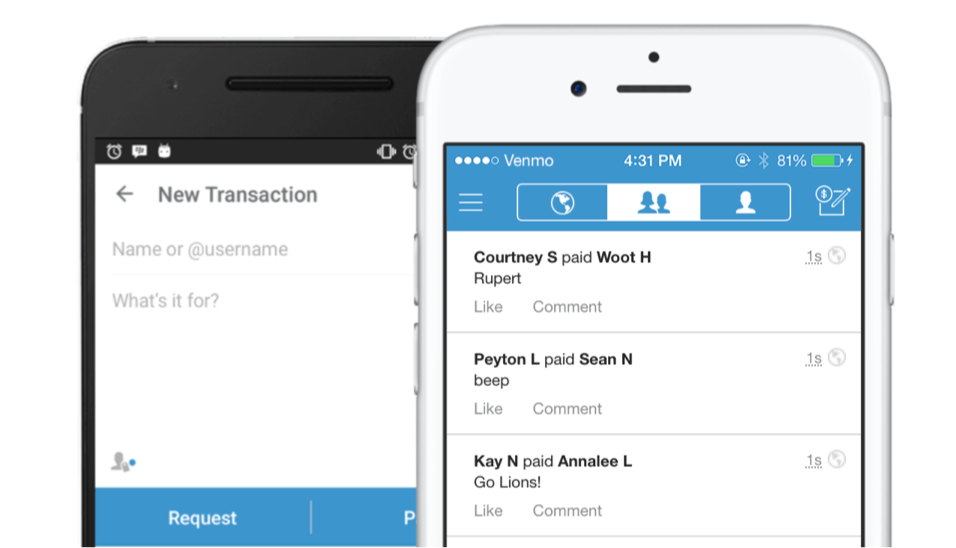

Custom handles such as Twitter’s @user system is far, far better. The best experience for a user is to be able to simply select the person they know and send to them.

Venmo’s integration with Facebook and the social graph as well as WeChat Pay’s leverage of the WeChat ecosystem are what made those products successful.

A decentralized system would have to exist outside the boundaries of a social network, while maintaining user privacy, but these networks can be used to bootstrap adoption.

The easiest step in that direction is through a decentralized @ or $ handle system.

“Merchants they engage”

For electronic cash to work, it must be easy to quickly make payments to merchants, online, but particularly in person.

In Asia, paying a merchant is as fast as scanning a QR code printed out and on display at the cash register. In the US, credit cards and NFC payments are quick and prominent.

A complete electronic cash system must have easy support for QRs and NFC with fast transaction time so the merchant can move on to the next customer quickly.

We are assembling a complete Peer-To-Peer Electronic Cash System

Introducing Mosendo

Editors Note: reminder that this was a 2019 announcement.

After searching for years for this solution, hoping someone would build it, I’ve decided to do something about it! I have joined forces with Rossco Paddison, an entrepreneur and educator who has trained 7500+ people on how to use a Bitcoin wallet and experienced their pains and confusion first hand.

This system is something we think the world desperately needs, and we can no longer sit back and wait for someone to make it happen, so we have formed Mosendo.com to complete this mission.

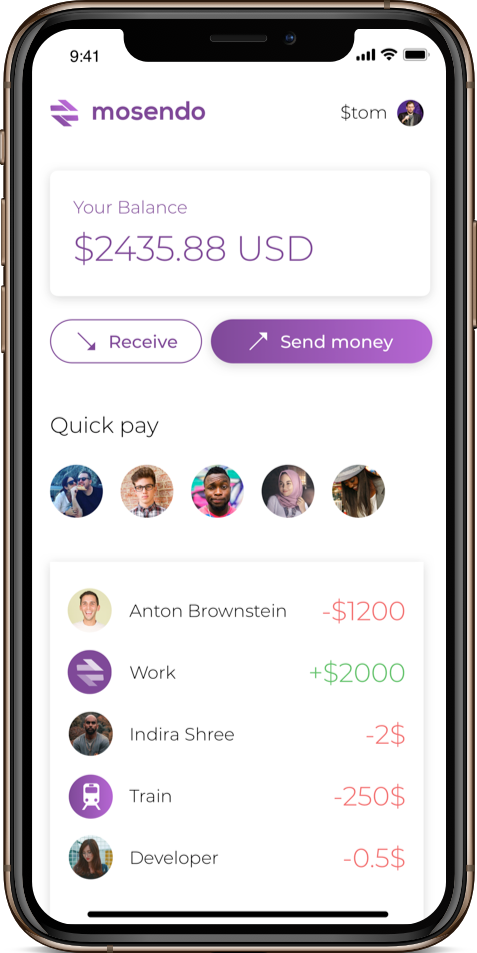

Our organization is focused on user experience and mainstream adoption, and so we are building what we see most lacking in the ecosystem, Mosendo, a decentralized payments app with UX for a mainstream user base.

Based on the wants and needs of users, and the criteria for p2p electronic cash, we are assembling a complete system requiring

Stable Cryptocurrency — A decentralized, censorship resistant, peer to peer, stable store of value that is low fee and has fast transaction times.

Simple App — An easy to use client wallet app denominated in only one or two fiat currencies which is accessible globally without ID. (Mosendo)

Fiat Access — A global network of fiat gateways to facilitate access to local banks

Stable Cryptocurrency

The stable store of value must be decentralized and sovereign grade censorship resistant, otherwise it is not much different from the existing bank infrastructure.

This means all the fiat backed bankcoins on the market such as USDT, USDC, TUSD, GUSD, PAX, and others, are not suitable choices for this system.

Bankcoins are still very susceptible to asset seizure by governments, banks, and even the less regulated organizations issuing the tokens. We can already see this in effect with companies outright stating they can revoke tokens based on violation of terms of service, and with Gemini refusing to honor tens of millions in withdrawal requests by trading companies in good standing.

Rule of thumb — anything backed directly by fiat in a bank is not censorship resistant or decentralized.

Fiat pegged cryptocurrencies are therefore the most promising at the moment. These coins are pegged to the value of a fiat currency but not backed by them.

Ideally the value stabilization did not rely on pegging to fiat value, but no other method of maintaining or evaluating stable value has come on to the market so far. I suspect this will be a chicken and egg problem, where cryptocurrency adoption allows for new methods of determining stable value, and so pegging to fiat is a bootstrapping method.

The most interesting decentralized pegged stable crypto on the market so far are MakerDAO’s $DAI, Synthetix, and Duo.

Others to watch are Reserve and Constant, which are currently fiat backed but have a roadmap to becoming decentralized and fiat pegged.

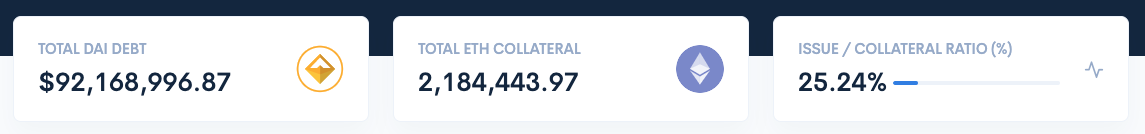

DAI in particular has hit an important milestone for cryptocurrency adoption — liquidity.

With over $90m in issued stable token, $30m avg daily trading volume, healthy collateralization, and constant steady growth, DAI has finally hit a point that no decentralized stable cryptocurrency has hit before, it possible to run a small but complete economy using DAI.

Scalability and Fees

MakerDAO and DAI are both currently built on the Ethereum network, so we are only considering solutions built on Ethereum. Should Bitcoin network launch a stable cryptocurrency with sufficient liquidity, we would likely support it.

Ethereum should soon be releasing Serenity, a faster, lower fee version of the protocol.

Until then, we have several slightly less decentralized solutions to use such as xDai on Ethereum POA and the more decentralized payment channel network, Connext.

Initially, these give us a way to bootstrap the ecosystem with nearly instant transactions and zero fees, and build towards a multiple layer solution depending on transaction size and use case.

This means in the near future, some transactions will take place via side chains or payment channels, and some transactions will be settled directly on the Ethereum network.

The user will not have to experience ETH or GAS, which can be confusing and somewhat scary concepts for mainstream users.

Simple App — Mosendo

“Money” and “phone” are increasingly becoming synonymous, so for crypto adoption, an easy to use app is required.

The money in the app must be denominated and stored in the currency the user thinks in (likely the local fiat), with the ability to hold a secondary currency (likely USD). We achieve this by using DAI for USD and synthetic fiat currencies from synthetix.

It must be easy to transact with people, not public keys. We accomplish this through the use of decentralized $motags, saved contacts, QR codes, NFC, and privacy preserving social network import (anyone have ideas on doing this without our organization storing user data?).

No ID is needed to use the wallet or hold a balance as it is simply a non-custodial cryptocurrency client, opening doors to global adoption instead of being stuck in a particular jurisdiction.

Private keys are confusing to many users, and cryptocurrencies are currently lost due to lack of understanding. In Mosendo, the user gets the option of hardware wallet, seed phrase, recovery via their 5 closest friends and relatives, and a few other ideas we’re fleshing out.

Fiat Access

Ideally a p2p electronic cash system is a comprehensive experience that does not require ever using a bank account or cash. However, the transition will take time, and users will invariably find themselves needing paper cash or a bank account for various purposes.

Regulations on sending money, including and KYC/AML, create many of the problems we are setting out to solve. The app itself does not require KYC/AML, but instead will benefit from the existing compliance of money transmitter partners to exchange fiat for crypto.

The system can not rely on a single fiat gateway, but must instead allow a network of multiple gateways in every country to allow for people all over the world to gain seamless access to the cryptocurrency system.

Mosendo uses services such as Wyre for this, as well as other payment processors and cash top up merchants we are in talks with (anyone we should be talking to?).

The Road To Adoption

Peer-to-peer electronic cash system will find the strongest product/market fit in emerging economies such as Asia, Africa, and South America where there are acute pains around currency and money.

In these regions it is easy to find examples of hyperinflation, bank theft, government theft, corruption, and other issues that make local fiat currencies and banks less appealing.

These countries face the largest issues when it comes to cross border payments, such as remittances, cross border trade and travel.

Often currency controls prevent capital outflows from these countries, and predatory practices result in high fees for migrant workers sending their hard earned money back home.

Many of these regions already see significant adoption of volatile cryptocurrencies such as Venezuela and Zimbabwe in the face of hyperinflation.

Many African countries already have high adoption of mobile money systems such as mPesa’s centralized SMS based payments.

Many countries already use telecom phone service top up credits as a form of currency, particularly India, Thailand and Indonesia.

Developing SE Asian countries have high smartphone penetration and saw high usage rates for speculating on cryptocurrencies, laying a foundation for cryptocurrency wallet literacy.

Additionally, the relatively small geographic size of of SE Asian countries causes frequent cross border currency issues.

SE Asia in particular will be a region of high growth for a properly implemented cryptocurrency system.

Since the Mosendo team is already based in SE Asia, we will be here on the ground, learning from the everyday person how we can make the best experience for them.

From Burmese migrant workers in Thailand to Filipino virtual workers earning from overseas, we empower them to take back ownership of their earnings and avoid predatory money remitters and sketchy banks.

In the future, we dream of a day when not only I as an American can take out my phone to instantly pay an Indonesian street food vendor, but a Venezuelan can easily pay for currywurst in Berlin, and a Nigerian in Canada can easily send money to family back home, all quickly, cheaply, and safely.